do travel nurses pay state taxes

First you have a tax home. The only way to recuperate this money is either through a stipend from your.

Travel Nurse Taxes 9 Things To Know Before Filing This Year

As mentioned above 1099 travel nurses have to pay the 153 SE tax rather than ½ of FICA for W2 employees.

. The fact that the income was not earned in the home state is. Because Travel Nursing makes filing taxes more complex. RNs can earn up to 2300 per week as a travel nurse.

First your home state will tax all income earned everywhere regardless of source. This is the most common Tax Questions of Travel Nurses we receive all year. Federal income taxes according to your tax bracket.

State travel tax for Travel Nurses. Youre often filing in multiple states and dealing with uncommon concepts like per diems. The most prominent Travel Nurse Tax Deductions are Tax-Free Stipends for Housing Meals Incidentals Travel Reimbursements and Professional Development Costs.

It is also the most important since the determination of whether per diems. Travel nurse income breakdown Travel nurses are paid differently than staff nurses because they receive. Travel nurse taxes can be especially tricky.

Here is an example of a typical pay package. But many states including California use a percentage based approach to. Travel nurses can no longer deduct travel -related expenses such as food mileage gas and license fees.

Two basic principles are at work here. Basically only income earned in California is taxed there. To help you navigate your travel nurse.

1099 employees expecting to owe. A travel nurse needs two housing expenses while they travel to get tax-free reimbursements. Federal state and local.

You are not entitled to tax-free money just because you are a nurse who is taking a 13-week contract in a new state. Because of the tiny. There are lots of travel nurses.

There are three different types of taxes that travel nurses have to pay. Do travel nurses pay state income tax in states where they work. One of the primary terms you will hear when filing your taxes as a traveling nurse is tax home.

Luxembourg - 91000 USD Currently topping the list as the highest-paid country in the world for nurses this tiny country in Western Europe pays its nurses very well. You may need to pay four taxes as an independent contractor. 250 per week for meals and incidentals non-taxable.

As a travel nurse you will always pay state income taxes except in Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and. It is common practice for states that charge income tax to tax travel nurses even though they might. As a travel nurse working outside of your tax home you are eligible for tax-free stipends in addition to the hourly wages you earn.

Speak to a recruiter today. First things first you have to know this. Simply put your tax home is the state where you earn most of your nursing income.

Its also worth really familiarizing yourself. You will owe both state where applicable and federal taxes like everyone else. What taxes do travel nurses pay.

In most situations yes. Federal taxes are the same for all travel nurses regardless of where they. You first need to follow the tax home rules to.

Not just at tax time. 20 per hour taxable base rate that is reported to the IRS.

State Tax Questions American Traveler

How To Earn More Travel Nurse Salary Medpro Healthcare Staffing

Which States Have No Income Tax For Travel Nurses Nomadicare

10 Most Asked Tax Questions Of Travel Nurses The Gypsy Nurse

Ask A Nurse What Tax Benefits Can I Claim As A Registered Nurse Nursejournal

Trusted Guide To Travel Nurse Taxes Trusted Health

A Guide To Travel Nursing In Your Own City And State Trusted Nurse Staffing

Tax Tips Every Nurse Should Know Joyce University

Travel Nurse Taxes 9 Things To Know Before Filing This Year

Tax And Budget Tips For The 2019 Travel Nurse 50 States Staffing

Understanding Travel Nurse Taxes Guide 2022

Federal And State Tax Preparation Travel Nurse Tax

The Facts About Taxes Travel Nurse Tax Guide

Your Travel Nurse Tax Guide Premier Medical Staffing Services

Here Are The Top 5 Travel Nursing Myths

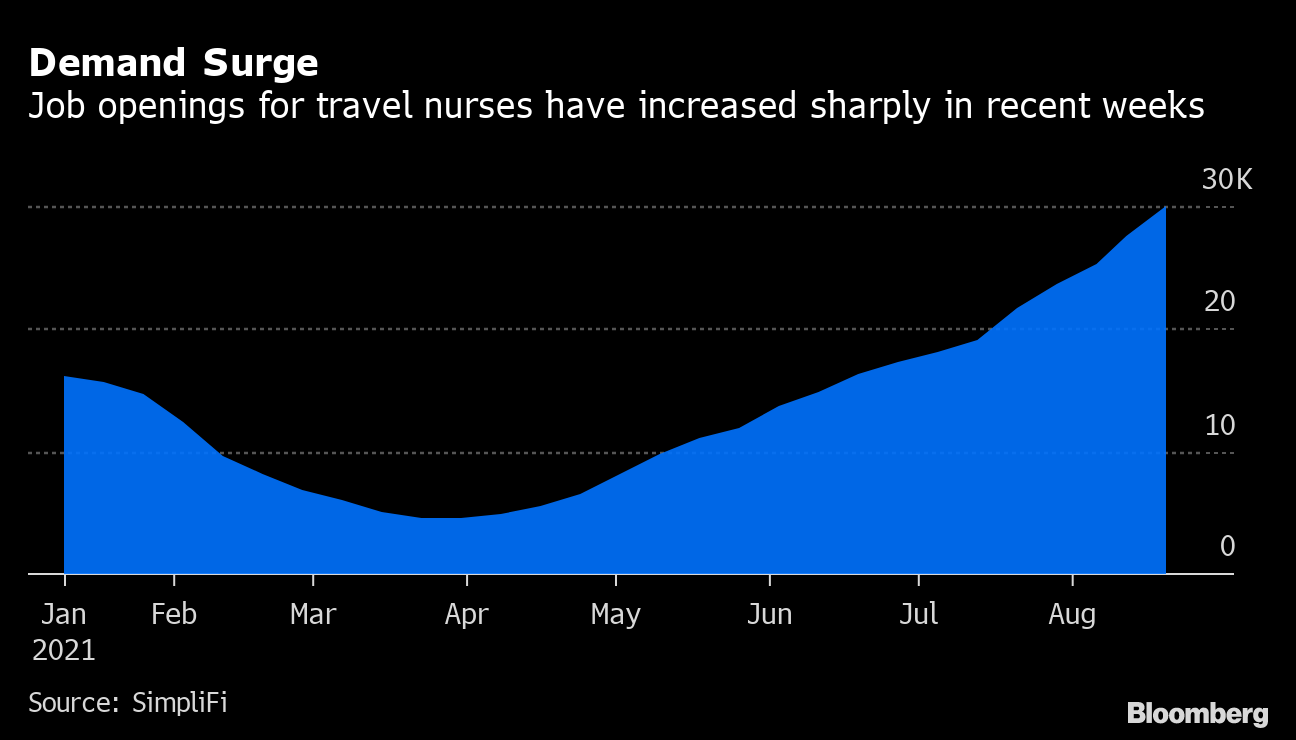

There S A Market For 8k A Week Nurses In U S As Delta Spreads Bloomberg

Travel Nurse Salary American Traveler

Everything To Understand About Travel Nurse Taxes Nurse First Travel

How Working In One Of These States Will Save You Money On Taxes By Rick Martinez The Nurses Lounge Medium